Paytm’s attempts to appease the regulatory authority are perceived as an effort to extend the deadline beyond March 15. The process of migrating merchants is proving to be more time-consuming than anticipated, causing concern among numerous banks regarding the re-verification of millions of subscribers’ KYC details.

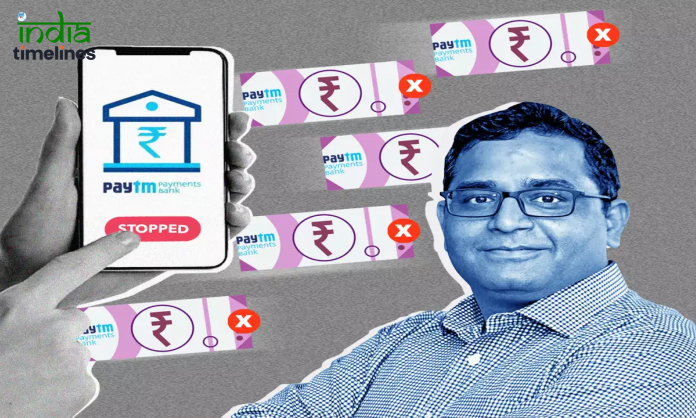

The decision of Paytm founder Vijay Shekhar Sharma to resign from the Paytm Payments Bank Limited (PPBL) Board and subsequently restructure it with independent members may have been initiated too late to influence the Reserve Bank of India (RBI), according to insights shared by multiple bankers with Moneycontrol. Despite the company’s evident efforts to demonstrate corrective measures following regulatory admonishment, it appears unlikely that these actions will salvage the embattled payments bank, as per a source familiar with the regulator’s stance.

The RBI’s directive issued on January 31 mandated specific actions from PPBL, prompting Paytm’s responses aimed at demonstrating compliance. However, the effectiveness of these efforts in mitigating the concerns of the regulatory body remains uncertain, with the fate of the payments bank hanging in the balance.

Know the Whole Story

Paytm founder Vijay Shekhar Sharma’s recent decision to resign from the Paytm Payments Bank Limited (PPBL) Board and initiate a reconstitution with independent members arrives amidst a storm of regulatory scrutiny. Yet, opinions within the banking sector suggest that this move may have come too late to sway the Reserve Bank of India (RBI), which has maintained a firm stance following the bank’s compliance failures.

The aftermath of Congress nominee Abhishek Manu Singhvi’s defeat in the Rajya Sabha polls, coupled with the victory of BJP candidate Harsh Mahajan, amplifies the urgency for Paytm to navigate the regulatory landscape effectively. However, despite visible efforts to rectify shortcomings post-regulatory admonition, there are doubts about the sufficiency of these measures to salvage the beleaguered payments bank, as indicated by a source close to the regulatory authority.

RBI’s directive on January 31 marked a critical juncture for PPBL, mandating the cessation of all banking services, including wallets and FASTags, except for the withdrawal of remaining balances due to persistent compliance lapses. PPBL’s subsequent reshuffling of the board, albeit commendable, occurred nearly a month later, leaving a mere 15 days to rectify operational deficiencies before the mandated suspension of banking operations.

The infusion of new independent directors into the PPBL board, including distinguished figures like former Central Bank of India Chairman Srinivasan Sridhar and retired IAS officer Debendranath Sarangi, reflects an earnest attempt to address regulatory concerns. However, the efficacy of such measures remains uncertain, particularly given RBI’s steadfast approach to enforcement, evidenced by past actions against major banks like HDFC Bank.

The complexity of PPBL’s predicament is exacerbated by the looming deadline for merchant migration, a monumental task with significant logistical challenges. The hesitance of several banks to undertake the tedious process of redoing KYC for millions of merchants further complicates matters, especially considering the absence of substantial financial incentives due to the lack of merchant payment commissions on UPI transactions.

Critics argue that Sharma’s actions may be perceived as too little, too late, given the prolonged history of compliance issues plaguing PPBL. Despite Sharma’s efforts to disassociate himself from operational matters within the bank, his prominent role in liaising with RBI during regulatory inquiries has not gone unnoticed, raising questions about accountability and governance.

The recent resignation of Sharma from the PPBL board, coupled with the formation of an advisory committee under former SEBI chairman N Damodaran, signals a concerted effort to address regulatory concerns. However, doubts persist regarding the adequacy of these measures to assuage RBI’s stringent requirements.

RBI’s recent directive to facilitate the seamless migration of all UPI @paytm handles to other commercial banks underscores the urgency of the situation. PPBL’s pivotal role as a payment service provider for Paytm UPI accounts necessitates special approval from the regulator to ensure uninterrupted service beyond the March 15 deadline, highlighting the complexities of transitioning assets and functions to alternative banking partners.

Paytm’s partnership with Axis Bank, HDFC Bank, and Yes Bank to operate its UPI services as a third-party application provider (TPAP) introduces additional complexities in the migration process. Despite concerted efforts to align with regulatory mandates, the timeframe for executing these transitions remains a pressing concern, particularly in light of the critical role played by digital payments platforms in India’s financial ecosystem.

In conclusion, Paytm’s journey to navigate regulatory challenges and ensure compliance with RBI directives reflects the evolving landscape of digital banking in India. While the company’s efforts to address shortcomings are commendable, the path ahead remains fraught with uncertainties, requiring strategic agility and proactive engagement with regulatory authorities to safeguard the interests of stakeholders and maintain the integrity of India’s digital payments infrastructure.